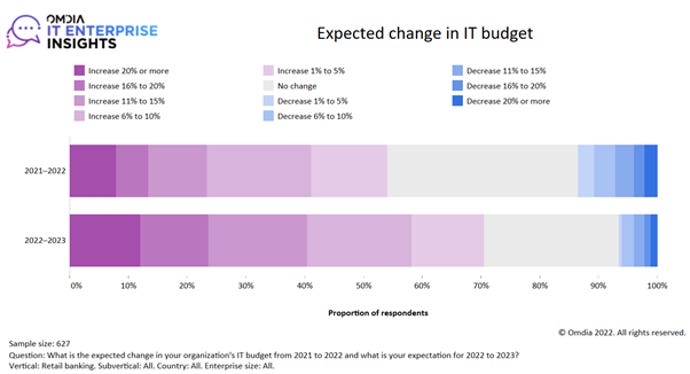

Good IT investment decisions are heavily dependent on the ability of the business to forecast what the short, medium, and long-term market environment will hold, so as to map investments to objectives and outcomes accordingly. At the start of 2023, accurately forecasting business, financial and political landscapes has never been more challenging. According to Omdia’s IT Enterprise Insights (ITEI) Survey 2022/23, seven in 10 IT decision-makers in retail banking plan to increase spending in 2023. As they place high importance on IT investments for the year ahead, they must prioritize the following three areas to achieve business continuity:

- Modernization of core banking to move the industry ahead with open APIs,

- Automation of processes to transform both customer and staff experience,

- Active engagement with what IT sustainability means to their organization.

Legacy Modernization Will Intensify in 2023; Core Banking Should Be a Key Priority

A shift to the cloud and composable banking to manage front- and back-office modernization more effectively have been key enablers of digital transformation recently. According to Omdia’s ITEI 2022/23 survey, 63% of banks rated their progress in the adoption of cloud as advanced. However, a further step up in modernizing core banking is needed to move the industry ahead with open APIs. Cloud-based core banking developed as real-time, API-first, and cloud-native solutions, can bring flexibility and scalability benefits, thereby meeting the current on-demand IT requirements of retail banks. Given the anticipated growth in real-time payments and open banking use cases, retail banks should consider next-generation cloud-based solutions to improve their existing capabilities.

Investment Should Materialize in High Level of Automation and Use of Analytics

Personalized (23%) and consistent cross-channel (22%) customer experience and a comprehensive view of the customer across business lines (20%) are the top IT projects for omnichannel banking strategy, according to Omdia’s ITEI 2022/23 survey. Banks also prioritize interaction with contact centers on chat and via chatbots, which allows a large proportion of queries to be resolved easily, thus reducing the cost of customer care.

Essentially, bankers need to have a clear understanding of where technology and automation provide an unambiguous benefit to their strategy (from digital channels to contact centers and branches) and where human employees are the most effective route to delivering the strategy and develop processes and services around that.

IT Sustainability Gains Prominence Through Well-defined Strategies by Retail Banks

Retail banks’ IT sustainability strategy currently revolves around broad spectrum including use of equipment that is compliant with industry standards, product takeback whereby promoting reuse of products and materials, move to fully digital processes, purchase of low-energy-consumption equipment and use of renewable energy and water management.

According to Omdia’s ITEI 2022/23 survey, more than a quarter of banks stated their sustainability strategy is well-defined and covers both their company and supply chain. Nearly one in five retail banks are on track with their strategy implementation, while the largest proportion of banks (nearly 30%) are in the assessment phase at present. However, the same number (1 in 5) also have no specific strategy at present.

While some banks are making significant progress, others report difficulty in maintaining compliance with existing rules, understanding which technologies will have the biggest positive impact and benefits. Suppliers and partners that do not share sustainability goals are also a challenge for banks. Therefore, entire organizations across the value-chain require to undergo a cultural shift to address IT sustainability initiatives pursued by many banks and thus help them achieve long-term business continuity.